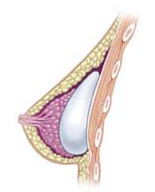

Breast augmentation can add up to a hefty sum which may be difficult for the average person to pay. But, there are many breast augmentation financing options and information which you need to be aware of before scheduling your cosmetic surgery.

Your Insurance may not Cover You

Health insurance does not usually cover elective cosmetic procedures. Breast augmentation falls into that category. An exception is when the surgery is concerned with breast reconstruction after severe chest trauma or a mastectomy.

Read the Small Print

Health insurance varies from company to company so make sure to read the entirety of the contract to see exactly what your insurance can cover. Breast augmentation, like all major surgeries, is a conglomeration of many fees. This includes the anesthesia, the implants themselves, the surgeon's fee and the operative care before and after the surgery. Now your insurance could cover the anesthesia or the post operative care even if it does not cover the cost of the breast augmentation surgery itself. Call your company to inquire about their policies involving breast augmentation. You may be able to use your health insurance in addition to other breast augmentation financing plans to pay for additional charges.

The CareCredit® Option

CareCredit® is an ideal choice for breast augmentation financing. It is a finance program centered on healthcare for individuals with no insurance or for those who will undergo procedures which are not covered by their health insurance. CareCredit® works by giving you a revolving credit which can amount to $25,000. A revolving credit requires you to pay a commitment charge after which you are allowed to spend the money as you see fit for any type of medical procedure. The payment plans are customized to fit the client's current needs and situation.

Financing with Capital One® Healthcare Program

Capital One® allows breast augmentation financing without using credit cards. In addition, this finance program offers a lower rate than most credit companies and more flexible payment plans. They permit their clients to repay the loan for up to 5 years. This ensures that you don't have to break your back or compromise your way of living to pay for a cosmetic procedure.

Ask your Surgeon

Many medical facilities have their own finance programs for procedures that are not covered by health insurance. Ask about their installment plans and payment terms. Your monthly payments will depend upon your credit rating, the estimated period where you are expected to fully pay the loan and the price of the surgery itself.

There is no need to worry about breast augmentation financing as long as you are careful and smart in choosing which finance plan to subscribe to. Medical facilities will give you application forms for their payment programs upon request. All major finance companies offer online application forms that you can easily fill up and submit. Securing an avenue for payment allows you to focus on more important things. Just like the credentials of your surgeon, the reputation of the medical facility and the type of breast augmentation procedure ideal for you.

skip to main |

skip to sidebar

Submit ExpressSEO Tools

Facebook Badge

Submit ExpressOpt-in Email Advertising

Popular Posts

-

The following are some landmarks in the history of telling the time. 1500-1300 BC Sundials are used in egyp...

-

In 2008, it was a public spat between Shah Rukh Khan and Salman Khan . This year it's a much-criticised party ...

-

Custom 3D and computer graphics have come a long way since their beginnings in the 1960's. The advancement in computer graphics was to ...

-

Deepika Padukone Breast Surgery , Deepika Padukone breast implants is latest Bollywood surprise for followers. The much talked news of ...

-

Günter Schlusche stood in what was once the foundation of Bernauer Street 10A, right in front of the cinder blocks and mortar that remained,...

-

Price should not be the deciding factor in choosing which surgeon or medical facility will handle your cosmetic procedure. Look for compe...

-

The word ' technology ' is often associated with ideologies about the future and the advancement of society. Although this statemen...

-

With the rise in the use of electric bikes, the question that must be asked is whether they will eventually make conventional bicycles obs...

-

Indian Cinema Gallery South Indian Gallery South Actress Gallery Amrutha Valli Actress Photos - Amrutha Valli Stills Gallery ....

-

Libyan rebels have been involved in a gun battle in the key town of Al Zawiyah just 18 miles (30km) from the capital Tripoli . The rebels...

Powered by Blogger.

Labels

- Anomalies and Alternative Science (1)

- Apple (1)

- Astronomy (2)

- Astronomy Alternative (1)

- Automobile (1)

- battery (1)

- Beauty (1)

- Bicycle (2)

- BMW (1)

- Breast (1)

- Breast cancer (1)

- Breast implant (2)

- Bristol (1)

- Broadband (1)

- Business (3)

- Carl Sagan (1)

- Cat (1)

- Clock (1)

- Computer graphics (1)

- Computer Science (1)

- Construction (2)

- Consumer Goods and Services (3)

- Cycling (1)

- Data rate units (1)

- Department of Homeland Security (1)

- disney (1)

- Dwarf Hamsters (1)

- EBay (1)

- Economic growth (1)

- Educational technology (1)

- Electric bicycle (1)

- Electric motorcycles and scooters (1)

- ElectricVehicle (1)

- Energy (1)

- Freight forwarder (1)

- Freight Forwarding (1)

- Future Technology (1)

- God (1)

- Hair Color (1)

- Haiti (1)

- Health (1)

- Hemorrhoid (1)

- Hewlett-Packard (1)

- Himalayas (1)

- History (1)

- Human (1)

- IBM (1)

- India (1)

- India news (20)

- Information technology (1)

- Information Technology Infrastructure Library (1)

- Information technology management (1)

- Infrastructure (1)

- Internet access (1)

- IPhone (1)

- iPod (1)

- Laser (1)

- Lethal Weapon (1)

- Martin Heidegger (1)

- Moringa (1)

- Nanotechnology (1)

- Nursing (1)

- Nursing shortage (1)

- Nutrient (1)

- Nutrition (1)

- People (1)

- Pregnancy (3)

- Pregnancy Symptoms (1)

- Racing bicycle (1)

- RFID (1)

- Road bicycle (1)

- Servers (1)

- Shiva (1)

- Skin (1)

- Small Business (1)

- Smartphone (1)

- Space Transportation (1)

- sport (1)

- sport news (2)

- Sporting Goods (3)

- StarChase (1)

- Steel (1)

- Sundial (1)

- Surgery (1)

- Tattoo (1)

- Tattoo removal (1)

- Technology (6)

- Technology news (4)

- time (1)

- Trade association (1)

- Transport (1)

- United States (5)

- Virtual reality (1)

- Vitamin (1)

- Water clock (1)

- Water-fuelled car (1)

- Weight loss (1)

- Wireless (1)

- world news (12)

Blog Archive

-

▼

2011

(89)

-

▼

July

(53)

- Women hold 'Slutwalk' to shatter sexual stereotype...

- Bipasha's mom makes ramp debut!

- Rakhi Sawant ka press conference

- PMO dismisses report on Manmohan Singh looking the...

- Yeddy sends resignation to Gadkari, to meet Governor

- Statistical highlights of Day 2 India-England seco...

- Frantic US debt talks near deal

- 5 Simple Facts about Breast Augmentation Financing...

- How to achieve skin that glows - Natural beauty se...

- The Dirty Truth About Cheap Breast Implants

- Unknown Facts About Breast Implant Revision Reveal...

- Tattoo Removal Companies - Laser, Dermabrasion, an...

- Top 10 Foods for Women’s Health

- Uncomplicated Body fat Loss Tricks - three Incredi...

- Finding The Right Hair Dye To Suit Your Needs

- The job of building is never an easy one. Constru...

- Custom 3D and computer graphics

- How Can We Prepare For the Next Big Haiti Earthquake?

- Technology or spirituality: Which one will 'save' us?

- Future of Building and Construction Companies

- Stainless steel constructions and their benefits

- Panama is developing into a strong country today...

- See The Future World At Epcot And Magic Of Fantasy...

- iPod Nano 6th Generation Review

- Hewlett-Packard's ProLiant 6th Generation Server P...

- Moringa - The breast feeding supplement

- The Black Dwarf Hamster

- Common Causes of Hemorrhoids

- See Various stages of cat pregnancy

- Know Pregnancy Week By Week

- Pregnancy Calendars for Fun and Education

- Can Your IT Infrastructure Meet The Growing Needs ...

- The Future Of Broadband Technology

- Flexible IT Managed Services for Excellent IT Infr...

- International Freight - The Infrastructure in Denmark

- The Future of Racing Bikes

- Injecting a Bit of Technology in Women’s Bicycles

- Are electric bikes the future?

- Uses of Electric Bykes

- Non-Lethal Weapons - Police Technology Targets Enh...

- Future of Space Transportation

- How You Can Have Cutting Edge Technology at Your F...

- What is the Future of Nursing Careers

- The future of technology - water powered cars

- The Future of Technology

- Our Future in Technology

- Future Technology - From Intelligent to Emotive

- Apple iphone cell Get the Future Technology Today

- RFID devices revolution in future technology

- Future Technology For You by tuhin

- Cars and future technology involved.

- First Time Small Business Grant

- When is the Best Time to List on eBay?

-

▼

July

(53)

Recent Posts

Blogger Tricks

Blogger Themes

Download

Copyright © 2011 Miracle World | Powered by Blogger

Design by Free WordPress Themes | Bloggerized by Lasantha - Premium Blogger Themes | Powerade Coupons

0 comments:

Post a Comment